4 Steps to Form a Private Company

PLT stands for Perkongsian Liabiliti Terhad is an equivalent of a Limited Liability Partnership (LLP). All entities registered under this form carries the abbreviation ‘PLT’ in their names (e.g., GHI Consulting PLT).

The Process: An Overview

Assuming you’ve decided to incorporate a Limited Liability Partnership (LLP) with our help, there will be process for you to undergo in order to achieve your objectives. The series of steps are as follows:

Step 1: Meet and Speak with Us

That’s right. It starts with your first call to us. You’ll meet with us, and tell us everything about what you have in mind. You’ll also provide us with all details and documents pertinent to the application.

Step 2: Sign and Return Our Quotation

After Step 1, we’ll review your request, and issue you a quotation, listing our price. If you agree, you’re to sign and return the quotation to us.

Step 3: Settle Your Application

After Step 2 is done, we’ll help you prepare your forms and supporting documents, and submit them to SSM, along with settling all applicable application fees.

Step 4: Settle Everything Else

Once your application is approved, you’re advised to get all other business licenses needed before your LLP begins operating. If you’d like, we could help you with those as well.

How is pricing determined for this service?

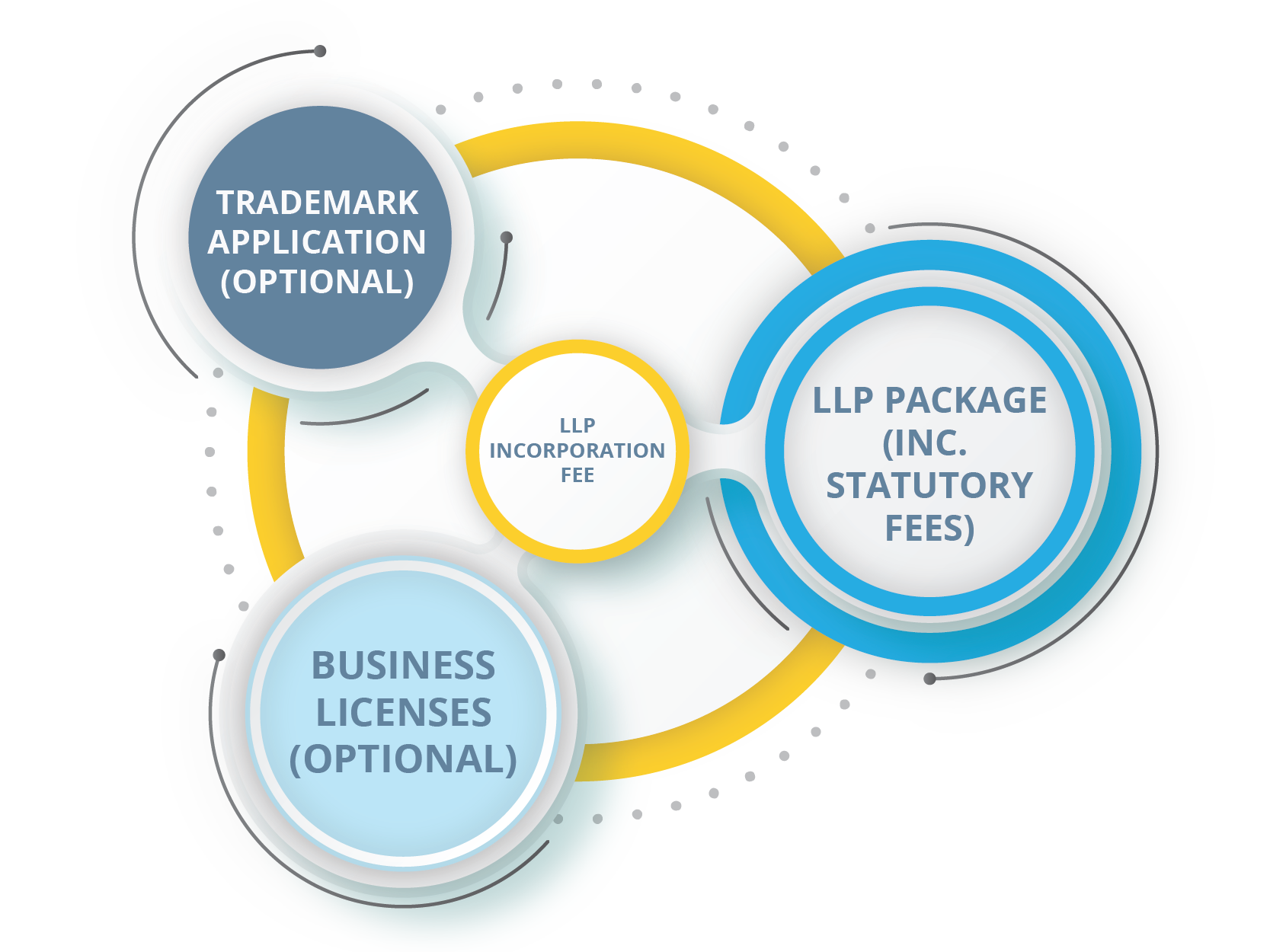

The incorporation fee for LLP, subject to SST, mainly consists of a one lump-sum LLP package (inclusive of statutory fees). However, if you require our assistance to obtain business licenses and trademarks, we may assist in those tasks as well, with additional charges.

Incorporate Your LLP Now

Frequently Asked Questions

Why would a LLP be better for me than incorporating a company?

The LLP provides the flexibility of organizational arrangement through the partnership agreement whereas a company is subject to a more stringent compliance requirement.

Is there any restriction as to what kind of business can use LLP as a business vehicle?

No. It is for all kind of lawful businesses with a view to make profit.

Who can be the partners in an LLP?

Individuals (natural persons) or bodies corporate or a combination of both.

Is a Perjanjian Perkongsian Liabiliti Terhad (i.e., LLP Agreement) absolutely required?

It’s akin to the concept of having a shareholders’ agreement. It isn’t legally required for you to have one. Among the things that such an agreement must include are provisions stated in the Second Schedule of LLP Act 2012. Therefore, not having a Perjanjian Perkongsian Liabiliti Terhad does not preclude your PLT from having to abide by those anyway. Therefore, if you don’t have one, you may simply refer to the provisions as stated in the Act.

Can two companies form LLP?

Yes. These are the most common form of joint ventures.

Can an existing business vehicle such as a company or a partnership firm convert into an LLP?

Yes. In the case of a company, only a private company incorporated under the Companies Act 1965 / 2016 is allowed. In the case of a partnership, only firms which are registered under the Registration of Business Act 1956 or any firms carrying on professional practices are allowed.

What will be the position of a private company / conventional partnership which converts to an LLP?

After a conversion, the status of the private company / conventional partnership shall be deemed to have been dissolved.

Can a sole proprietorship convert into an LLP?

A sole proprietorship cannot convert into an LLP as it only has 1 member. The sole proprietor must find at least one more person to be a partner before he can register an LLP.

How do I incorporate an LLP from scratch?

This mode only involves submitting relevant details to SSM. However, the submission must be done by the compliance officer.

The details are to be submitted are as follows:

– proposed name of your LLP;

– nature of business of your LLP;

– proposed address for registered office of your LLP;

– names and particulars of every partner in your LLP;

– names and particulars of the compliance officer(s) of your LLP;

– consent letter from any professional or regulatory bodies if the LLP will be engaged in professional practice; and

– any other details that SSM demands from the applicant.

All application must be made by the compliance officer via MyLLP system, accessible via SSM4U Portal.

How do I convert from a conventional partnership to an LLP?

For conversions from conventional partnerships, you will also need to submit the following:

– the name and registration number of your partnership;

– the registration date of your partnership; and

– proof that your partnership is still solvent as of the application date and will be so in the near future.

If your partnership is one involved in professional practice, the additional details that you must submit are the following:

– the name and registration number of your partnership;

– the registration date of your partnership; and

– proof that your partnership is still solvent as of the application date and will be so in the near future.

– a letter showing approval or no objection by relevant bodies responsible for regulating the professional services that your partnership provides.

How do I convert from an private company into an LLP?

For conversions from private companies, you’ll also need to submit the following:

– the name and registration number of your company;

– the incorporation date of your company;

– proof that your company is still solvent as of the application date and will be so in the near future;

– proof that your company has settled all statutory fees and any other dues to any governmental bodies as of the application date;

– proof that your company has notified, via at least one widely-circulated newspaper in Malaysia and also via the Federal Gazette, of its intention to convert into a LLP; and

– proof that all of your company’s creditors consent to its decision to convert into a LLP.

May I do all submissions to incorporate an LLP on my own?

No, all registrations are to be done by a compliance officer registered to represent your LLP. Not just anyone can be a compliance officer. SSM’s regulations specifies the following conditions for all compliance officers of LLP’s:

– the person must be either a partner of the LLP or anyone qualified to be a company secretary under Companies Act;

– the person is at least 18 years of age; and

– the person is a citizen of Malaysia, and is mainly residing in Malaysia.

This is not an average joe or jane that you appoint to merely submit documents. Compliance officers is namely responsible for the following:

– submissions of all statutory documents to the authorities;

– informing or updating authorities of changes in any details submitted;

– keeping registers and other statutory documents in the registered office;

– ensuring that your LLP publish its registered name and registration number outside of its registered office and place of business; and

– anything else specified by SSM for your LLP.