By Mr. Lam Kwai Soon, COO & Tax Managing Director, Cheng & Co Group of Companies

Understanding the Special Voluntary Disclosure Programme 2.0 (SVDP 2.0)

On 24 February 2023, the finance minister, Datuk Seri Anwar Ibrahim announced that Malaysia will introduce Special Voluntary Disclosure Programme 2.0 which will commence on 1st June 2023 to 31st May 2024. The programme will cover direct tax and indirect tax. The programme encourages taxpayers whoever has under-declared their income and under-reported their sales and services or other indirect tax are welcomed to come forward with good faith to do the surrender and it will be fully waiving on the penalty.

For those taxpayers who may have some income which might be accidentally under-declared or some mistakes were made on overclaiming the expenses for tax deduction are waiting the Inland Revenue Board of Malaysia (IRB) and Royal Malaysian Customs Department (RMCD) to unveil the details of the programme and to evaluate the next actions.

However, for those taxpayers who think that their direct tax as well as the indirect tax were properly reported with full compliance may not be interested to know further about the programme. Perhaps there may be another group of taxpayers may think that the programme is a golden opportunity in the event that they might have some mistakes made in the direct tax and indirect tax compliances and they can participate the programme to avoid paying any penalty.

If you are one of the taxpayers in the former group which you already knew that you have some tax issues for wanting to participate the programme. However, for those taxpayers in the latter groups they may have a risk that they might not even know they might have some issues in the direct and indirect tax compliance and may overlook the opportunity.

Let’s us further to brief you that when coming to tax compliance, most of the taxpayers only are thinking of the perspective of compliance e.g., annual tax submission on time, tax payments are made on time, employer form (Form E) submitted on time, PCB (Potongan Cukai Berjadual) are computed correctly and paid on time etc. They do not think of other perspective.

A Look at the Four Key Tax Perspectives

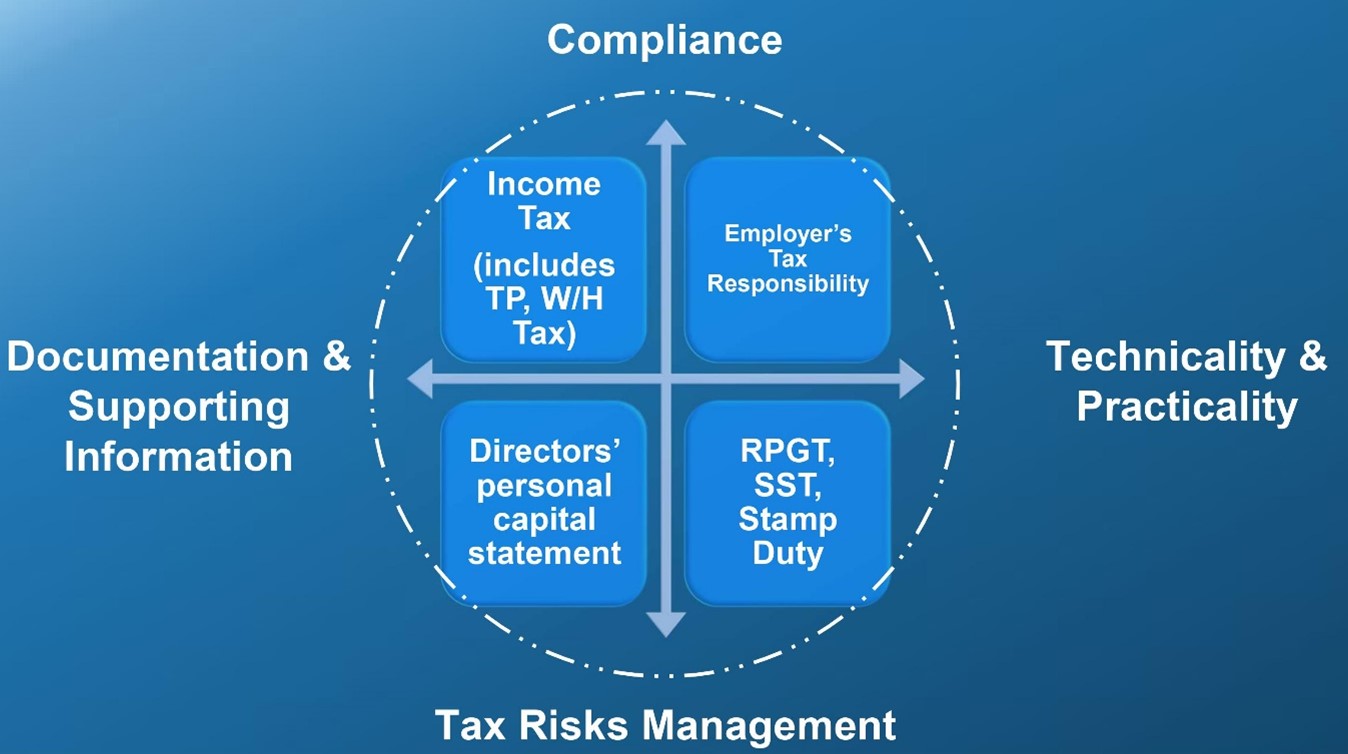

Being tax consultants and when we dealing with tax audit, tax investigation, transfer pricing, tax planning or other tax advisory assignments, we always to consider four perspectives which are:

And we are not only to consider the above perspective from the angle of the income tax alone, we also to consider other areas like director’s personal capital statement, transfer pricing, SST etc. If the director always injected funds into the company or always paying the expenses on behalf of the company, we need to assess the implication on his capital statement and the risks on the director. Other than that, what are the documentation that the director needs to maintains to substantiate his financial position in order to mitigate the tax risks in the event that there is tax audit is initiated on him.

For more information, you may refer to our article on Understanding Capital Statement Malaysia: LHDN’s initiative to assess personal tax.

Below is the diagram that illustrating the concept of the above.

1. Compliance

Many taxpayers would understand this perspective very easy as it covers how well that you have complied with the requirement of the tax laws in term of submission on time, timeliness of tax payment, declaring the right tax amount, and etc.

2. Technicality vs practicality

This perspective is talking about there are many daily business operational practices that taxpayers get used to follow and doing regularly without knowing that there can be a gap with technicality. And there might be the circumstances that IRB misinterpret the laws at their benefit without having well understanding of the businesses’ practices. Let’s discuss with a few examples for well understanding purposes.

Example 1 – Goldsmith’s Dilemma: Record Keeping in Family Outsourcing

We come across a goldsmith that he buying the 999 gold bars and to produce jewelry products. He outsources part of the workmanship to outsiders and part of the workmanship is outsourced to his parents who are staying with him in the house. On the workmanship outsourcing to outsiders, he has kept a proper record in term of every gram in and out. However, he did not keep the records on the workmanship that done by his parents which he think they are friendly party. The tax issue raised in the tax audit was the grams 999 gold bars purchased not tally with the grams of gold bars that sent out for workmanship and the IRB suspected the difference was unreported income. And he not able to support with records how many grams of gold are done by his parents for workmanship and IRB did not accept with just a verbal explanation without proof.

Example 2 – Cross-Border Business and Dividend Discrepancies

Another example, a client of ours who has business in Indonesia where his shareholding in an Indonesian company is held in trust by a nominee who is his friend. Every year, the Indonesian company would declare dividend to the shareholders. My client who is the real shareholder would receive these dividends and usually the nominee will give the dividend to him in cash and he bring it back to Malaysia and then banked-into his bank accounts. Now the technicality is, he is not the shareholder on the formal records of the company as his shares are held in trust under the nominee’s name. Technically he has the problem to prove that the cash banked into his bank accounts are dividend income from Indonesia. There is no banking transfer and no documentation to substantiate the transactions.

Another common example involving transfer pricing, for Malaysia SMEs there are common practices that the inter-company financial assistance or friendly loans without charging interest provided to the related companies. They may think that they have no issue on transfer pricing and not required to prepare transfer pricing documentation if all the companies are subject to tax in Malaysia. In our experience within this one year, we come across a few cases that IRB raised the issue on the inter-companies interest free loan and impose interest that result in additional tax payable in overall effect and another case that IRB required the SME to submit transfer pricing documentation when the company is selected for tax audit.

For more information, you may refer to our article on Transfer Pricing for SMEs in Malaysia: Common Misconceptions and Transfer Pricing for SMEs in Malaysia: What It Means To You.

3. Documentation and supporting information

Documentation for supporting purpose in tax does not mean any documents are good enough, we must understand what documents are considered a strong documentation for mitigate the tax risks. One of the strong documents is the documents that provided by third party for example invoice issued by supplier is much stronger than the payment voucher prepared by the accounts executive of the company. We come across that an accountant of our client who asked us that his boss required him to issue a cheque to a person as the sales commission. And he thought that as long as this payment is not cash and he issue CP58 form to that recipient, there should be no issue. However, the tax risk is even he can prove that the payment was paid to that recipient via cheque, IRB may still can challenge that the payment is not related to business and not qualified for tax deduction purposes. In order to further manage the tax risks, we advised the accountant to prepare a simple engagement letter to that recipient to engage him as sales consultant and the engagement letter should spell out the basis of the commission calculation.

In the case of dividend from Indonesian company that we mentioned above, we also advised our clients must have the proper documentation that reflect the whole business arrangement in order to manage the tax risks.

4. Tax risks management

In this perspective, we need to evaluate the risks after finishing the assessment of the above three perspectives, is there still having the gap that not able to close and is there any alternatives or evaluating the impacts of every potential scenario happen to let the taxpayer to know what preparations that they need to make in the worst scenario.

Conclusion

We hope that with the above some simple sharing will let you understand more about what you need to consider when coming to make decision that should you participate the SVDP 2.0. If you still cannot decide or not sure what you should do, you are welcome to talk to our consultant and we have a systematic approach for the above methodologies to assist our clients to come out from the maze and gain confidence and clarity in the tax matters.