Taxation

Consultancy

Doing Business in Malaysia

Accounting

HR & Payroll

Wealth Management

Connection

FPAM

Our Business Partners

How Internal and External Assurance Assist the Performance of Company.

Assurance Services Assurance processes involve many legacy compliances, and it is fairly unique. Hence, many company owners might feel confused about what exactly internal and external assurance are, and what…

COVID-19 – Key Takeaways & Response to Pandemic Risk for Businesses

As the global situation of the spread of the COVID-19 virus deteriorates, most multinational conglomerates are pursuing professional advice on the pandemic insurance policy. Many corporations in Malaysia are now…

Post MCO Series 2 – CMCO Extended To 9th June 2020, How Can You Increase Company Cash Flow

Malaysia Prime Minister Tan Sri Muhyiddin Yassin has just announced that Conditional Movement Control Order (CMCO) will be extended till 9th June 2020. A lot of you may have feel…

Post MCO Series 1 – What To Do For Business In Post-MCO?

Business operations are expected to be resume on 4th May 2020. What the businessman should do? Cheng & Co hereby list down the important things should handle immediately.

Powering On Through Trying Times

The whole world is under the cloud of COVID-19, more so Malaysia with the sudden spike in infection cases. With the government declaring a movement control order on 16 March…

What To Do Now? COVID-19 Survival Guide for SMEs

Nearly 10 days into the lockdown in Malaysia, the new cases of Covid is increasing but hopefully will go down by soonest. Some are saying the Government might extend the…

Responding To The Trade War

The Sino-US trade war is dominating headlines almost every day. It was made worse by the collapse of trade negotiations between the two countries last month. There are differing opinions…

Key challenges and barriers that hinders SMEs to go Public

The Challenges that SMEs faced when Listings Listing is the gateway for a company into capital market where funds can be raised for business development and expansion. Many SMEs in…

Keep Your Portfolios Sustainable via ESG Investing

Table of ContentsHOW DOES ONE MEASURE ESG PERFORMANCE?WHAT IS IN IT FOR MALAYSIANS TODAY?WHERE DO MALAYSIANS GO FROM HERE?ABOUT THE AUTHOR Source: 4EJournazine, Vol 23, No 4, 4Q2023 (pg 28-29)…

Nurturing Growth & Sustaining Success

Dato’ Dr. Chua Hock Hoo Executive Chairman, Cheng & Co Group Source: 4EJournazine, Vol 23, No 4, 4Q2023 (pg 30-31) Download: Nurturing Growth & Sustaining Success Cheng & Co, originating in…

Enhance Finance Operations: Embracing Digitalisation Of Accounting

IN TODAY’S WORLD, BUSINESSES NEED TO EVOLVE QUICKLY TO ADAPT TO RAPID CHANGES IN THIS DIGITAL ERA. THE ACCOUNTING PROFESSION, SPECIFICALLY, HAS UNDERGONE MAJOR TRANSFORMATION IN RECENT YEARS. ONE OF…

Embracing Digitalisation Of Accounting For Better Finance Operations

IN TODAY’S DIGITAL WORLD, BUSINESSES NEED TO EVOLVE QUICKLY TO ADAPT TO RAPID CHANGES. THE ACCOUNTING PROFESSION, SPECIFICALLY, HAS UNDERGONE MAJOR TRANSFORMATION IN RECENT YEARS. ONE OF THE MAIN CHANGES…

Global Business Services: BPO in E-Commerce Industry

From Transition to Transformation Young and mobile entrepreneurs have adapted to the prevalence of money-making opportunities which is specifically internet or app-based, creating a modernize way of doing business…

Cloud Accounting To Boost GBS Studies

Malaysia’s Global Business Services (GBS) industry continues to enjoy solid upward growth and is expected to see greater gains this year. With this comes the need to nurture a highly…

Simplified Guide to the Transition of Sales and Service Tax Rate Changes

Download: Simplified Guide to the Transition of Sales and Service Tax Rate Changes Following our recent announcement on the hike in SST rate from 6% to 8%, effective from 1st…

Transfer Pricing Disputes: Protecting Your Business with Proper Documentation

You have been hearing from LHDNM, us, and many others telling you that proper TP documentation is crucial, and must be produced in a timely fashion (during the related party…

You should not miss considering to participate the Special Voluntary Disclosure Programme 2.0 (SVDP 2.0) of Malaysia

By Mr. Lam Kwai Soon, COO & Tax Managing Director, Cheng & Co Group of Companies Understanding the Special Voluntary Disclosure Programme 2.0 (SVDP 2.0) On 24 February 2023, the…

Closing a Business in Malaysia: Essential Tax Documents to Secure from LHDNM

Planning to shut down your company, Limited Liability Partnership, or Labuan Entity in Malaysia? Or possibly shifting your business out of the country? If so, it’s important to tie up…

LHDNM’s New Guidelines for E-Filing for YA2022

It begins with a brief introduction to e-filing, detailing, among other things, your responsibility as a taxpayer to file your tax returns, the deadline for e-filing, the different forms for…

Questions on Individual Income Tax Malaysia in 2023?

What is the 2023 individual income tax rate in Malaysia? Chargeable Income (RM)Current Tax Rate (%)Proposed Tax Rate (%)0 – 5,000005,001 – 20,0001120,001 – 35,0003335,001 – 50,0008650,001 – 70,000131170,001 –…

Avoid Penalties: Employer’s Ultimate Guide to Tax Filing Dates in Malaysia

Learn about the submission deadlines, penalties and other important details about important tax filing forms for employers in Malaysia.

Generate Your Bill Number for Real Property Gains Tax Payments vis e-CKHT Form 502

Until 28.02.2023, you can still use manual CKHT Form 502 to generate your Bill Number. After then, you’ll need to use e-CKHT to generate the needed form in order to…

Understanding Capital Statement Malaysia: LHDN’s initiative to assess personal tax

Introduction Perhaps you haven’t heard of a capital statement. Recently, LHDN requested many individuals (many of them were directors and chief executives like yourself) to complete and submit immediately two…

2023 Malaysia Tax Submission Important Timeline

Remember to prepare your tax forms on time. File your companies, employers, individuals, partnership or association tax hassle-free with Cheng & Co Tax agents.

Settle Your Tax Installment Payment Before 15 January 2023

Since New Year 2023, LHDNM has a new e-Billing system, where you may generate your billings, and make payments. However, at this time, the system is currently experiencing technical difficulties,…

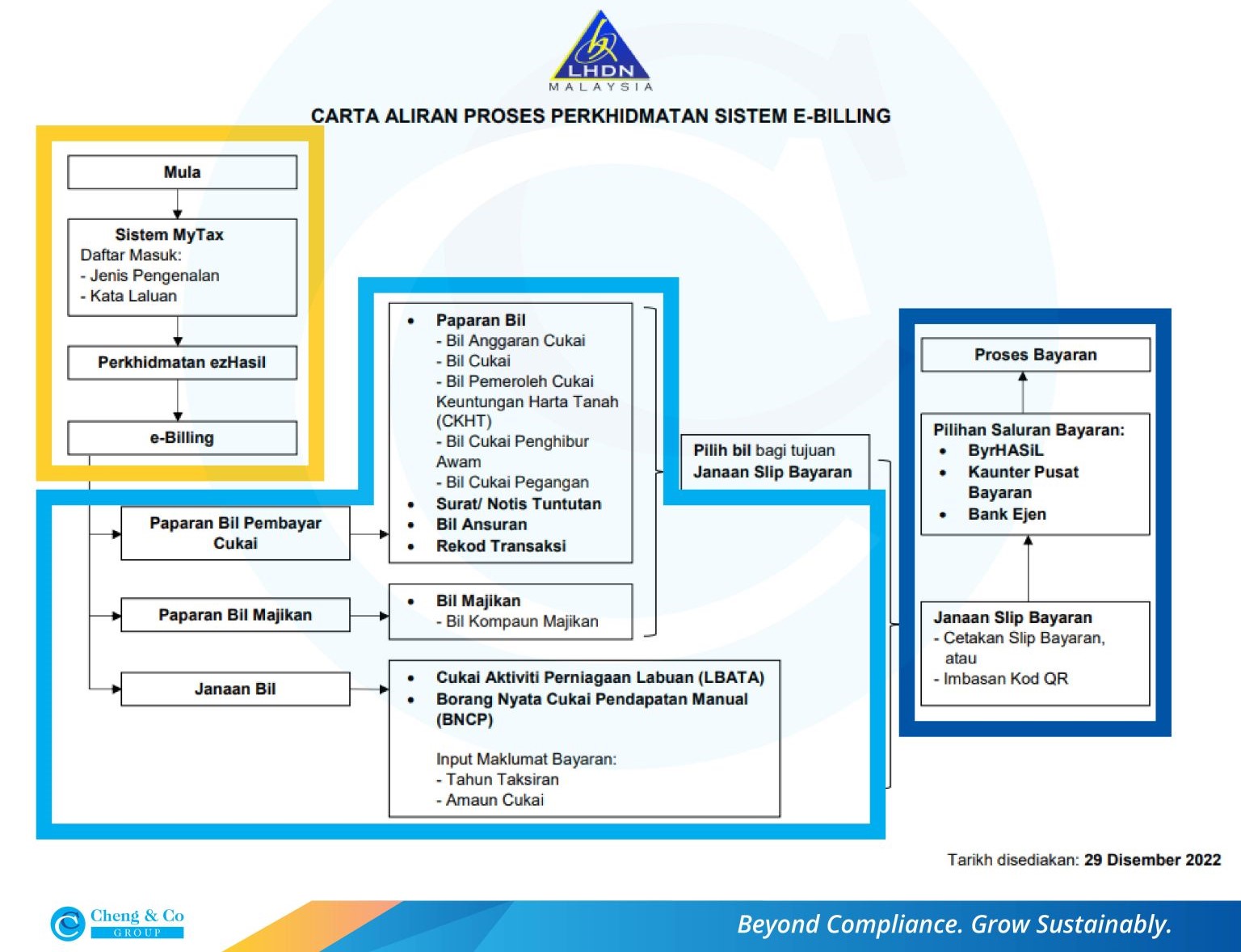

Tax Update 1 Jan 2023 on Bill Number & E-Billing

Since 1 Jan 2023, you’re required to accompany each direct tax payment made to LHDN with a bill number, to be generated by LHDN’s e-billing system, under MyTax. Under Login…

Updated Guidelines on Tax Treatment of Digital Currency Transactions on 26 August 2022

Since 2019, LHDN has made it clear that they are taxable in the document titled “Guidelines on Tax Treatment of Digital Currency Transactions”, with the latest version was released on…

Transfer Pricing for SMEs in Malaysia: Frequently Asked Quesion (FAQ)

We understand the pressures faced by SMEs when it comes to compliance with the Transfer Pricing Documentation. Common questions or beliefs floating around their mind would be: My companies do…

Transfer Pricing for SMEs in Malaysia: Common Misconceptions

Introduction Transfer Pricing (TP) is a worldwide issue. Currently, Malaysia’s TP legislation is based on the recommendations given in the OECD TP Guideline, which is also being applied in other…

Automatic Exchange of Information Regime

Automatic Exchange of Information Regime – a new international development on measures for combating cross-border tax evasions The recent Panama Papers scandals have exposed how the big multinationals and powerful…

EIS & SOCSO Contribution: A Guide for Employers in Malaysia

Like EPF contributions and MTD, Employers are also obliged to make deductions for SOCSO and EIS contributions on behalf of employees, in addition to making a small contribution to the…

EPF Contribution: Employer’s Obligations in Malaysia

EPF is a savings fund that private sector employees and employers in Malaysia are obliged to contribute monthly. Although employees’ contribution comes from their salaries, it is actually the responsibility…

A Guide to Monthly Tax Deductions (MTD) in Malaysia

Before monthly tax deduction (MTD) was introduced, it was the responsibility of employees to ensure that, whenever due, income tax is paid from their employment income. When MTD was introduced,…

Pay Rates for Extra & Normal Working Hours in Malaysia

Employment Act 1955 (Act 265) specifies the way in which one can calculate one’s ordinary rate of pay, and also that rate of pay for work done outside of normal…

Payroll Records for Payroll Calculations in Malaysia

Payroll documentation serves as sources for the figures used in payroll calculations. Even if you were to outsource your payroll processing, you still need to maintain payroll documentation for each…

Efficient Payroll Processing in Malaysia: A Comprehensive Guide

Many of you are in business, and your goal is to always maintain a great bottom line for your company. Unless your business is a one-person show, you must have…

The Impact of Blockchain on the Accounting Profession

Blockchain is known as Distributed Ledger Technology (DLT), a digital system that records asset transactions and their details in multiple locations simultaneously. It offers audit firms and accountants an opportunity…

Global Business Services: BPO in E-Commerce Industry

From Transition to Transformation Young and mobile entrepreneurs have adapted to the prevalence of money-making opportunities which is specifically internet or app-based, creating a modernize way of doing business…

Reflection on 23 Years of Leadership, Growth, and Passion for SME Success

For over 23 years, Amerie Kok has been at the helm of Cheng & Co Group, a leading accounting and professional services firm. Despite the challenges and changes over the…

Inspiring Women Leaders Of The Future

By Ms. Tay Lee Hoon, Head of Cheng & Co’s Women Leadership Centre Challenging Stereotypes: Women as Capable Leaders Despite persistent stereotypes and biases in certain parts of the world,…

Insurance Assistance During Covid-19 Crisis

The Covid-19 pandemic is rocking the global economy unlike anything seen before. With countries enforcing lockdowns resulting in business and borders getting shut temporarily, things are not looking particularly healthy…

Sustaining Family Businesses through Generations

FROM humble beginning in 1993, Cheng & Co has been serving SME clients for more than 25 years. We have observed that family-owned businesses are among the most common in…

Single But Not Care Free

Michael (not his real name), 36, is a manager in a multinational company. He is single and has been with the company for more than 12 years. The problem is,…

Retirement Life Goal – Analysis And Assessment Process

RETIREMENT LIFE GOAL – THE ANALYSIS AND ASSESSMENT PROCESS The Life Goals Analysis is a tool that allows you to identify if you are on track to achieve your personal…

1 Plan for Life (1P4L): Protecting You Come What May

“If a child, a spouse, a life partner, or a parent depends on you and your income, you need life insurance.” Suze Orman Mention life insurance to just about anyone…

CCRM Group Medical COMBO Plan: Addressing The High Premium Conundrum

Today’s Business Dilemma Rising operating costs are a big concern for businesses, particularly the small and medium-sized enterprises (SMEs). It’s seen as one of the biggest challenges yet in recent…

The Connection Issue 1st Semiannual 2023 – SMEs Sustainability in Malaysia 2023

Get your free copy of The Connection E-Magazine: SMEs Sustainability in Malaysia 2023, now available in both English and Mandarin. What’s in store for you: Cheng & Co Group in…

How great leadership pushes your brand up during this slowdown?

Learn how to use the principles of leadership from two bestselling books to inspire your brand followers and achieve your goals in challenging times.

Don’t fix your prices! Improve them through value-based pricing to counter shrinking bottom line!

Learn from Mr Lam Kwai Soon, COO and Tax Managing Director of Cheng & Co Group, on how to apply value-based pricing to your products or services to counter inflation…

Go Digital: Digitalise Your Business To Save on Operational & Reporting Cost

Author: Dr Ma Yue, CEO, DigiwinSoft Malaysia Business isn’t easy. We’re living in times where timely, reliable data reporting means the difference between success and failure. You have a computer. What…

Sustainable Business Practices To Sustain Revenue and Save Cost in 2023

Find out from Dato’ Dr. Chua Hock Hoo, Executive Chairman of Cheng & Co Group, on the best practices that can help you reduce cost and increase revenue for your…

How could SMEs in Malaysia muddle through the economy in 2023?

On 6 January 2023, Cheng & Co. Group held its iSGV2025 Sustainable Growth Programme to coach its staff members on sustainable business growth. Invited to the programme was Tan Sri…

The Connection Issue May – Aug 2020: Covid-19 Business Recovery Strategy Guide

Many companies are on the brink of downsizing or, worst, collapsing. Small and medium enterprises (SME) which makes up close to 98% of businesses and is the most important cog…

Single But Not Care Free

Michael (not his real name), 36, is a manager in a multinational company. He is single and has been with the company for more than 12 years. The problem is,…

The Connection Issue April 2018

Key challenges and barriers that hinders SMEs to go Public The Challenges that SMEs faced when Listings Listing is the gateway for a company into capital market where funds can…

Year of Transformation: Cheng & Co’s Journey to Becoming a Leading International Accounting Firm

By Dato’ Dr Chua Hock Hoo Towards the end of 2016, we declared that 2017 will be a year of Transformation for Cheng & Co towards our vision to become…

Do you know that, as Director of PLCs, you are required to attend The Mandatory Accreditation Programme Part II: Leading for Impact?

On 6 June 2023, The Securities Commission Malaysia (“SC”) and Bursa Malaysia had announced the roll out of a new mandatory onboarding programme on sustainability for members of Boards of…

Benefits of CA 2016 for Corporate Structure Planning to Avoid Dispute

In the past, under Companies Act 1965 (“CA 1965”), many people have the wrong perception thinking that one person controlling more than 50% shareholding in a Company, has the controlling…

Empower Your Transactions with Sunway Money: Your Go-To Remittance Partner

Sunway Money Receives Prestigious Recognition as the Fastest Growing Remittance Service Provider at Global Business Outlook Awards 2021In a significant milestone, Sunway Money has been honored with the title of…

Sunway Money – Ways To Send Money Overseas

Ways To Send Money Overseas If you recently have had a need arise to perform an international money transfer or remittance, the abundance of transfer options may seem overwhelming to…

Sunway Money – What Is Remittance and Who Uses It

What Is Remittance and Who Uses It? The term ‘remittance’ may be familiar to some but, most might know it in more informal forms such as ‘transferring’ or ‘sending’ money…

Cheng & Co Group and DapatGaji Sign MoU to Promote Earned Salary Access

Cheng & Co Group partners with DapatGaji to offer earned salary access, helping employees bridge the gap between paychecks and avoid unnecessary debt.

Use DapatGaji to provide employees earned salary access!

What is DapatGaji DapatGaji is an app that that lets your employees access their earned salary anytime. This way, they can manage their cash flow better and avoid unnecessary debt…

Cheng&Co x Curlec To Provide Innovative Payment Solutions For SMEs

CHENG & CO JOINS FORCES WITH CURLEC TO PROVIDE INNOVATIVE PAYMENT SOLUTIONS FOR SMES Cheng & Co and Curlec are pleased to announce a strategic partnership that will allow Small…

Partnership between Cheng & Co and TGS Lime Tree

TGS Lime Tree And Cheng & Co Set To Collaborate In November 2016 TGS Global organized their global annual conference at the Grand Hyatt in Kuala Lumpur. The global conference…

Hospitality Industry – Turning Risk Into Opportunity

The highly competitive nature of the hospitality industry needs no introduction. Hotels that can’t compete effectively in this environment will be adversely impacted and risk becoming distressed assets. In situations…