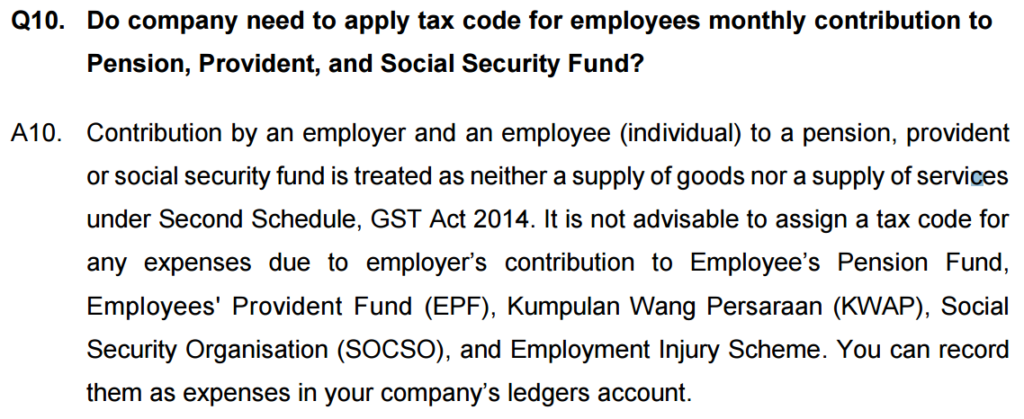

A GST-registered company is advisable not to assign a tax code for the employee’s salary/allowance/bonus expenses. Contribution by an employer and an employee to a pension, EPF, or SOCSO is not a supply therefore it is advisable not to assign tax code for any expenses due to employer’s contribution to EPF, Employee’s Pension Fund, KWAP, SOCSO, and Employment Injury Scheme.

Kindly refer to the GST Guide on Accounting Software Enhancement Towards GST Compliance. (Link)

Any further GST enquiry, you may drop by to our GST Healthcare Centre at your nearest Cheng & Co’s Office. (Link)

For further info, do visit our Cheng & Co’s GST services page. (Link)